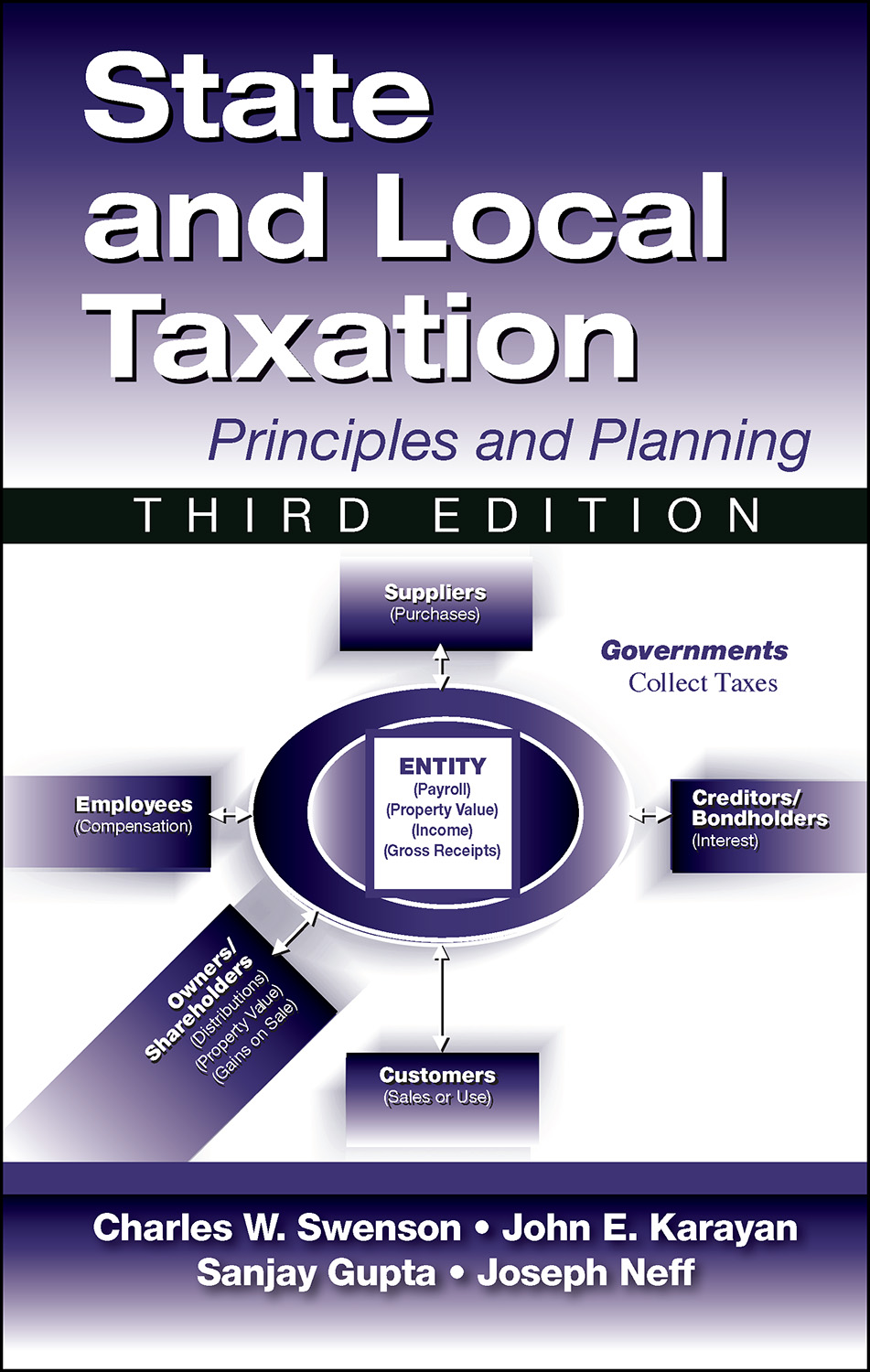

State and Local Taxation, 3rd Edition

$59.95

By Charles W. Swenson, John E. Karayan, Sanjay Gupta, and Joseph Neff

Hardcover, 6×9, 376 pages

ISBN: 978-1-60427-095-2

January 2020

Description

In recent years, stunning advances in telecommunications, capital mobility, and distribution channels have not only greatly increased the number of transactions and ventures subject to multiple taxation, but also have made it easier—for those who know what to look for—to plan around such taxes. Tax and legal professionals, entrepreneurs, and business managers must have a fundamental understanding of the state and local tax implications of key transactions. Those who are able to identify state and local tax issues also can make more effective use of tax consultants because challenges and opportunities can be spotted as they arise before basic negotiations are concluded and the outline of the deal solidified.

Written by a team of CPAs, professors, and tax lawyers with over 120 years of combined experience, State and Local Taxation: Principles and Planning, Third Edition, covers the important tax issues of today’s global business environment. The authors draw upon numerous real-life examples to identify and explain the fundamental principles of state and local taxation and how to incorporate these principles into strategic business planning.

Key Features

- Shows how to identify state and local tax issues and spot challenges and opportunities as they arise

- Details the principles of multi-state taxation and provides an understanding of their effect on business operations

- Explores the role of state and local tax issues in a strategic business environment and discusses taxation from a strategic planning perspective

- Explains the economic implications of management decisions involving the application of tax laws

- Presents an overview of major state and local taxes including income tax, sales tax, property tax, and employment taxes

- WAV offers instructional material for classroom use—available from the Web Added Value™ Download Resource Center at www.jrosspub.com

About the author(s)

Charles Swenson, PhD, CPA, is a Professor of Taxation and the Elaine & Kenneth Leventhal Research Fellow at the Leventhal School of Accounting at the University of Southern California, where he teaches (among other courses) graduate classes on state and local taxation. His professional experience includes service as a tax consultant at PricewaterhouseCoopers. Professor Swenson also has been a Visiting Scholar at the University of California at Los Angeles’ Anderson School of Management and a Visiting Professor at the California Institute of Technology. Winner of several American Taxation Association Outstanding Tax Manuscript Awards, Chuck has published extensively in leading journals such as The Accounting Review, Advances in Taxation, the Journal of Accounting and Public Policy, the Journal of the American Taxation Association, and the National Tax Journal.

John E. Karayan, JD, PhD, is a Senior Lecturer in Accounting at the University of Southern California’s Marshall School of Business and a Professor of Accounting Emeritus at the California State Polytechnic University, Pomona. He is a tax attorney with a Big 4 CPA firm background who left professional practice to become a full-time university professor. A former director of taxes at one of the world’s largest software companies, Professor Karayan has remained active outside of academia as an expert witness on accounting issues in complex business litigation. He also served for years on the Board of Directors of the world’s foremost manufacturer of anti-terrorist vehicle access barricades. Dr. Karayan’s books include Strategic Business Tax Planning with Charles Swenson. John also has published articles in journals ranging from The Tax Advisor to the Marquette Sports Law Review and has spoken before professional groups such as World Trade Institute, California Continuing Education of the Bar, the European Accounting Association, and the California Society of CPAs.

Sanjay Gupta, PhD, CPA, is the Dean of the Eli Broad College of Business, as well as a Professor of Accounting, at Michigan State University. A CPA with a law degree, Professor Gupta has served as a consultant to the Big 4 and national CPA firms, as well as with multistate giants such as Motorola and Charles River Associates. Dr. Gupta has published in such prestigious venues such as the Journal of Accounting and Economics, the National Tax Journal, the Accounting Review, the Journal of the American Taxation Association (JATA), the Journal of Accounting and Public Policy, and Tax Notes. His awards include being the 1993-94 Price Waterhouse Fellow in Taxation, one of two awarded nationally, as well as receiving a nationally competitive Ernst & Young Tax Research Grant. Sanjay also has been recognized by his peers for his superb teaching. In 2000 he received the Arizona Society of CPAs Accounting Education Innovation Award.

Joseph W. Neff, JD, needs no introduction to the state and local tax community. His previous experience includes partner in the Los Angeles office of PricewaterhouseCoopers, where he was national director of the middle market tax practice. He was also managing director of the SALT practice (as well as a partner) at RSM McGladrey.

Table of Contents

Part I: A Framework for Understanding State and Local Taxation

Chapter 1: Introduction

Chapter 2: Constitutional Law Limitations

Part II. Principles of State and Local Taxation

Chapter 3: Corporate Income and Franchise Taxes

Chapter 4: Sales and Use Taxes

Chapter 5: Property Taxes

Chapter 6: Employment Taxes

Part III. Select Applications

Chapter 7: Mergers, Acquisitions, and Restructuring

Chapter 8: Credits and Incentives

Chapter 9: Taxation of Electronic Commerce

Part IV. Other Areas

Chapter 10: Taxation of Employees and Sole Proprietorships

Appendices

Index

Reviews

“State and Local Taxation: Principles and Planning is an excellent treatise covering the increasingly complex multi-state and local tax issues faced by businesses. SALT exposure can be significant for both public and private companies and internal and external tax advisors must be up to speed on this rapidly evolving specialty niche. This well-organized and comprehensive analysis from the experts will help with the proactive planning that can have a substantial impact on a firm’s overall tax rates, cash flow, and enterprise value.”

—Blake Christian, CPA/MBT, Partner, HCVT

“Our firm has many high-net-worth clients with businesses in a number of states. We need an easy-to-understand but comprehensive guide on state and local taxes, and this text does a superb job of filling that role. I keep it next to my desk and use it on a regular basis.”

—Adrian Stern, CPA, CFE, CFF, CICA, CrF.A., Managing Partner, Clumeck Stern Schenkelberg & Getzoff

“As a practitioner on the front lines, it is important to have a state and local text which is thorough and well-written. This book does that and more!”

—Maria Milos, Enrolled Agent/Tax Analyst, Block Advisors

“This is a well written text and provides clear guidance on SALT matters. I highly recommend it.”

—Ricardo Samaniego, Director of Tax, Samsung USA

“As a controller for a large manufacturing company, this book provides a framework to understand state and local taxation. It’s a must have and should be placed nearby for quick reference and strategy discussions with ownership. This valuable guide provides planning strategies and insights into the state and local tax laws which have saved millions of dollars in taxes. It has also provided the value needed to enhance my professional career.”

—Bryan Graves, Director of Finance, Fleetwood USA

Related products

-

Six Sigma for Small and Mid-Sized Organizations

Retail Price: $49.95$44.95 Add to cart -

The EDGAR Online Guide to Decoding Financial Statements

Retail Price: $34.95$29.95 Add to cart -

Leading High-Performance Projects

Retail Price: $44.95$39.95 Add to cart -

Handbook of Integrated Risk Management for E-Business

Retail Price: $89.95$69.95 Add to cart -

Financially Focused Project Management

Retail Price: $54.95$44.95 Add to cart